5/6 Torchbearer Weekly Policy Update

Thank you letting us be your trusted source for local, state, and federal policy updates. Let’s dig in …

- U.S. Attorney General Moves to Reclassify Marijuana as Lower-Risk Drug

- Child Care Crisis

- Worker Pay Pressures Persist

- U.S. Economy Adds 175k Jobs in April, Falling Short of Expectations

- Experts Fear ‘Catastrophic’ College Declines Due to Botched FAFSA Rollout

- Share the Torchbearer Newsletter with Your Network!

- Important Dates

Let’s dive in.

U.S. Attorney General Moves to Reclassify Marijuana as Lower-Risk Drug

The Justice Department has recommended loosening restrictions on marijuana, allowing broader access to the drug for medicinal use and boosting cannabis industries in legal states. The measure, if enacted, would not legalize marijuana at the federal level but is a milestone in President Biden's campaign to address racial and criminal justice inequities caused by the war on drugs. The reclassification of marijuana from Schedule I to Schedule III would place it in the same category as prescription drugs. This historic policy shift comes as marijuana is increasingly accessible and has become a multi-billion dollar industry in the US.

Why it matters: The recommendation is significant because it could lead to further cannabis reform and normalization. It signals a recognition that the dangers of marijuana have been overblown and that criminal cases involving the drug should be deprioritized. This information matters for all staff as it has the potential to impact the legalization of marijuana at the federal level, affecting the industry and consumers alike.

The big picture: The proposed change in federal drug policy reflects the growing acceptance of marijuana and the need to address outdated regulations. The majority of Americans now live in states where marijuana is legal, and this recommendation acknowledges that the current classification is inconsistent with public opinion and scientific evidence.

The bottom line: The recommendation to loosen restrictions on marijuana brings the country closer to federal legalization and represents a significant step towards achieving equitable drug policies. It is an important development for the cannabis industry, consumers, and advocates who seek to reform marijuana laws. (Washington Post)

Child Care Crisis

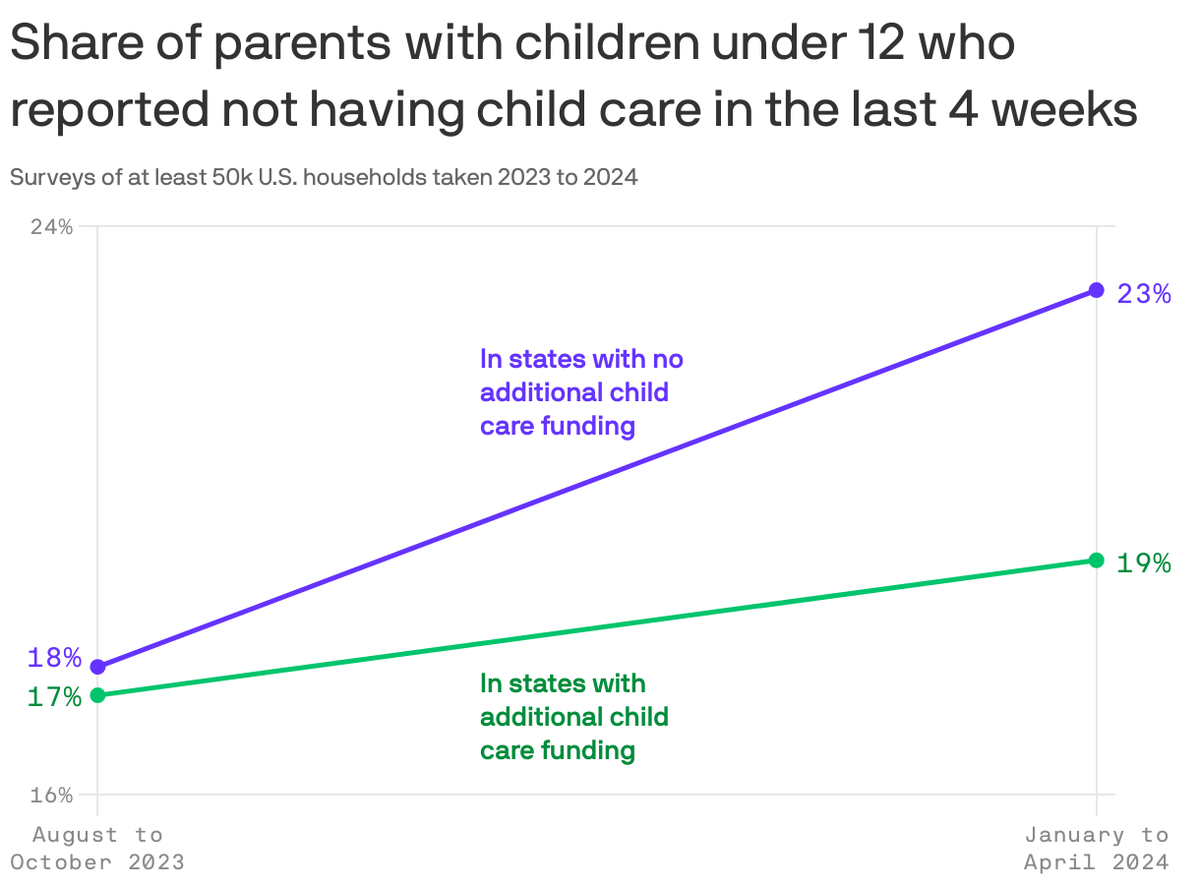

Data: National Women's Law Center analysis of Census Bureau data; Note: Alaska, California, Illinois, Kentucky, Maine, Massachusetts, Minnesota, New Hampshire, New Mexico, Vermont, and D.C. have additional funding; Chart: Axios Visuals

The share of families without access to child care is rising in the wake of the child care cliff, the date last year when pandemic-era federal funding for the industry ran out, according to an analysis of census data shared exclusively with Axios.

Why it matters: The child care industry is in crisis mode with more centers closing, raising tuition, facing staffing shortages, and being unable to operate at full capacity.

Zoom in: Eleven states and Washington, D.C., stepped in with funding to stabilize the industry post-cliff, including Alaska, Illinois and Massachusetts.

- The National Women's Law Center compares the situation for parents in those states to the rest of the country.

- In the funded places, parents are more likely to have access to child care, and women are less likely to have to step away from work because of care issues.

By the numbers: In the states without additional funding, 23% of parents with kids under age 12 reported this year that they had no child care in the prior four weeks, up from 18% in the pre-cliff period.

- States with additional funding saw just a 2-percentage-point increase.

Between the lines: Without reliable child care, parents — typically women — can't go to work, a blow to families' financial security.

- You can see that play out in the analysis. In states that provided additional child care funding, the share of women who said they couldn't work because they had to care for a child out of school or without child care fell to 32% from 45%.

- In states without additional funds, the number only moved to 39%, from 45%, a change that the National Women's Law Center said was "not statistically significant."

The big picture: The child care industry was never really the picture of financial health before the pandemic — it's a low-margin business with a customer base that has limited means to spend — but the pandemic threatened to put it over the edge.

- $24 billion from the Biden administration's massive COVID relief bill in 2021 helped stabilize the situation. The money went to providers, which used it to pay workers bonuses and cover rising expenses for rent, mortgages, utilities and supplies.

- Without it, in a post-pandemic world of higher costs and a tighter labor market, an increasing number of centers are struggling.

Most providers said they were experiencing staffing shortages and were under-enrolled relative to their current capacity, according to a February survey from the National Association for the Education of Young Children.

- The top reasons for under-enrollment? Lack of staff and lack of affordability for families.

- "My wait list is over 400 kids long and yet I have classrooms I can't open due to not being able to hire staff," a center director in West Virginia says in the report. "Parents can't afford to pay more, and the state has decreased subsidy payments." (Axios)

Worker Pay Pressures Persist

Workers are seeing faster pay growth and pricier benefits than in pre-pandemic times, as the labor market continues to flourish.

Why it matters: That is one huge factor keeping the economy healthy. But it raises red flags for Federal Reserve officials worried about lingering inflation, which now appears more difficult to stamp out than at the end of last year.

- The latest read on worker compensation adds to the barrage of data — including consumer and wholesale prices — that showed an acceleration in inflation pressures in the first quarter.

Driving the news: As the Fed begins a two-day policy meeting, the Labor Department reported the Q1 Employment Cost Index, considered the best barometer of how much employers spend on compensation.

- It rose 1.2% in the first quarter, the Labor Department said. That's up from 0.9% in Q4 and above the 1% analysts expected.

- Over the past year, wages and salaries for all workers are up 4.4% — slightly higher than Q4. That is down from the peak 5.27% seen in 2022, but above the roughly 3% seen before the pandemic and the inflation shock.

The intrigue: The Q1 increase in compensation was particularly high among public sector workers — which may offer some comfort in that pay of government workers is less likely than the private sector to reflect the core inflationary dynamics of the economy.

- Over the past year, compensation for state and local government workers is up 4.8% — only slightly below the 4.9% peak last year.

- But in some sense, this just reflects that government workers saw smaller pay gains than private sector counterparts as inflation took off in 2021 and 2022, and governments are now adjusting pay to remain competitive.

This "catch-up" effect is a sign that the inflation pressures built up in recent years are still working through the economy in a way that economic policymakers might not have anticipated.

Of note: Elevated compensation growth like that seen over the last year is not necessarily inflationary, given the strong growth in worker productivity.

- But productivity data is volatile, and there are no assurances that the improvement in output per hour of labor will keep rising as rapidly as it did in 2023.

What they're saying: "The Q1 ECI data are a fresh reminder of the long and uneven road we're on to a tamer inflation environment," Oren Klachkin, a financial markets economist at Nationwide, wrote in a note.

- The data "will only bolster the Fed's recent messaging that interest rates need to stay at current levels and that greater confidence is needed before the easing cycle can begin," Klachkin adds. (Axios)

U.S. Economy Adds 175k Jobs in April, Falling Short of Expectations

The U.S. economy added 175,000 jobs in April, below expectations, resulting in a higher jobless rate of 3.9 percent. This follows the Federal Reserve's decision to hold off on cutting interest rates due to strong economic indicators and inflation concerns.

Why it matters: The slower jobs report indicates that interest rate hikes are affecting a resilient labor market. The Fed's decision to delay rate cuts will continue to put pressure on the job market in the coming months.

The big picture: The Federal Open Markets Committee has cited a lack of progress in getting inflation back to 2 percent as a reason for holding interest rates steady. Inflation has increased to 3.5 percent, far from the Fed's goal. Fed Chair Jerome Powell acknowledges that gaining confidence will take longer than expected.

The bottom line: While job gains are positive for President Biden, the slight slowdown in April could give the Fed room to cut rates. High interest rates have increased borrowing costs and negatively affected the economy, exacerbating scrutiny of the Fed's rate policy. (The Hill)

Experts Fear ‘Catastrophic’ College Declines Due to Botched FAFSA Rollout

New FAFSA application rollout causing stress for high school seniors. Many students still haven't received financial aid offers, delaying college decisions. Decrease in FAFSA submissions raises concerns about low college enrollments. College admissions facing threats of closures and staff cuts. FAFSA problems impacting students' access to higher education opportunities. Bipartisan criticism and investigations surround the FAFSA rollout. Long-awaited updates to simplify the FAFSA form have caused more delays. Students struggle to complete the form due to technical issues. Emergency relief needed to support struggling colleges. Over 8 million student applications processed, but wait times remain. Some states offering alternatives to FAFSA process for state scholarships.

Why it matters: Students face uncertainty and financial hardships without timely FAFSA processing. The US education system is at risk of losing potential college students and exacerbating existing inequalities. The FAFSA rollout issues threaten students' dreams of pursuing higher education and achieving financial stability.

The big picture: The flawed FAFSA rollout undermines the accessibility and effectiveness of student financial aid. Sluggish FAFSA processing hampers decision-making and exacerbates financial stress for families. The consequences extend to colleges, raising concerns about financial viability and potential closures.

The bottom line: The FAFSA troubles impede students' access to higher education opportunities and hinder their ability to plan for the future. Immediate solutions and support are needed to address the delays, technical issues, and potential drop in college enrollments. (IBJ)

Share the Torchbearer Newsletter with Your Network!

Not signed up for our weekly newsletter? Sign up today!

Important Dates:

Tuesday, May 14th - Legislative Council