11/18 Torchbearer Weekly Policy Update

Thank you for letting us be your trusted source for local, state, and federal policy updates.

Let’s dig in…

- Indiana Republican Senators Reject Trump’s Redistricting Push; Won’t Convene in December

- Partial SNAP Benefits Issued to Hoosiers

- Trump Signs Funding Bill to End Historic Government Shutdown

- States Hope to Use Rural Health Money to Keep Doctors, Combat Chronic Disease

- 9 Finalists for Indiana Utility Regulatory Commission Openings Sent to Gov. Mike Braun

- Indiana to Keep Frank O’Bannon Scholarship Awards Flat for 2026-27

- Legislative Leaders to Look at ‘Tweaks’ to Property Taxes, Medicaid in 2026 Legislative Session

- Analysis: Property Tax Changes to Put More Pressure on Businesses, Owners of Low-Value Homes

- Share the Torchbearer Newsletter with Your Network!

- Important Dates

Indiana Republican Senators Reject Trump’s Redistricting Push; Won’t Convene in December

Senate President Pro Tem Rodric Bray

Indiana Senate Republicans have decided not to pursue President Trump’s push for congressional redistricting, defying pressure from Trump allies and Governor Mike Braun.

Why it matters: This decision marks Indiana as the first GOP-led state to reject Trump’s redistricting agenda, potentially impacting Republican gains in upcoming elections.

The decision: Senate President Pro Tem Rodric Bray announced that there aren’t enough votes to support the redistricting move, cancelling the planned December session.

Reactions:

- Gov. Mike Braun criticized the decision, urging legislators to support fair maps.

- Trump allies warned of political repercussions for Senate leaders, emphasizing the need to follow Trump’s agenda.

- Senate Minority Leader Shelli Yoder praised the decision, focusing on Hoosier priorities over partisan politics.

The backdrop: Indiana’s current congressional maps favor Republicans 7-2, a balance Trump supporters aimed to increase.

What’s next: Without the December session, updates to Indiana’s tax code in line with federal changes will be delayed until the General Assembly reconvenes in January. (Indiana Capital Chronicle)

Partial SNAP Benefits Issued to Hoosiers

Hoosiers eligible for Supplemental Nutrition Assistance Program benefits now have access to partial funds on their EBT cards.

Why it matters: More than 600,000 Hoosiers depend on federal assistance to afford food.

The big picture: SNAP benefits had been held up by the government shutdown, but two federal judges ordered the Trump administration to continue offering the benefits.

- The Supreme Court paused the order and the government told states to only process partial payments.

The latest: Those partial benefits were made available yesterday, according to a news release from Gov. Mike Braun.

What we're watching: With the shutdown winding down, Braun said full benefits are expected to be on their way soon. (Axios)

Trump Signs Funding Bill to End Historic Government Shutdown

President Trump signed a government funding bill, officially ending the longest shutdown in history after 43 days.

Why it matters: The shutdown disrupted government operations and affected thousands of federal workers, highlighting the political battles over funding.

Driving the news: Trump signed the bill in the Oval Office, blaming Democrats for the shutdown while surrounded by Republican lawmakers.

- The Senate passed the bill with a 60-40 vote, followed by the House’s 222-209 approval.

- The bill funds military construction, veterans’ affairs, and more through Sept. 30, with the rest of the government funded until Jan. 30.

Yes, but: The bill does not include extensions for Affordable Care Act subsidies, which Democrats had demanded. This omission could lead to increased healthcare premiums. (The Hill)

States Hope to Use Rural Health Money to Keep Doctors, Combat Chronic Disease

States are vying for a share of the $50 billion Rural Health Transformation Program to enhance rural healthcare services.

Why it matters: This funding aims to counteract severe Medicaid cuts, which threaten rural healthcare systems and could lead to hospital closures.

- Rural areas face significant healthcare access challenges, and this program offers a vital opportunity to mitigate financial strain.

Driving the news: All 50 states submitted applications last week, with proposals targeting emergency services, chronic disease management, and workforce recruitment.

- States like Missouri and North Carolina propose regional hubs to better address local healthcare needs.

The stakes: With $911 billion in Medicaid cuts looming, rural hospitals stand at risk.

- Over 700 rural hospitals are financially vulnerable, underscoring the urgent need for robust state strategies. (Indiana Capital Chronicle)

9 Finalists for Indiana Utility Regulatory Commission Openings Sent to Gov. Mike Braun

Gov. Mike Braun is on the verge of selecting three new members for the Indiana Utility Regulatory Commission (IURC) amidst rising energy prices.

Why it matters: The IURC plays a critical role in determining utility rates which directly impact Hoosiers‘ wallets.

- With energy costs soaring, the commission’s decisions will be under intense scrutiny by both political parties.

Driving the news: Out of 47 applicants, nine finalists remain, including six Republicans and three Democrats. Braun is expected to choose two Republicans and one Democrat, respecting party balance requirements.

What’s next: Braun aims to finalize his selections by the end of the year, joining the two existing members on the commission. The new members will face immediate challenges in addressing energy pricing concerns. (IBJ)

Indiana to Keep Frank O’Bannon Scholarship Awards Flat for 2026-27

Indiana’s Commission for Higher Education has decided to keep the Frank O’Bannon scholarship awards unchanged for the 2026-27 academic year, maintaining state-funded financial aid at about $168 million annually.

Why it matters: This decision affects about 37,000 Hoosier college students who rely on this need-based grant, ensuring their financial support remains stable despite uncertainties in federal aid changes.

Driving the news: Commission staff emphasized maintaining program appropriations without unexpected spending increases, with Cody Robison noting the focus on predictability.

The backdrop: Previously, award amounts were increased to restore pre-recession levels, but changes in federal aid eligibility led to increased spending, forcing adjustments in later years.

What’s next: The approved schedule will be reviewed by the State Budget Committee, and final award amounts will be communicated to colleges early next year. (Indiana Capital Chronicle)

Legislative Leaders to Look at ‘Tweaks’ to Property Taxes, Medicaid in 2026 Legislative Session

At an event Monday, Indiana legislative leaders said they aim to make minor adjustments to key issues like property taxes, Medicaid, and economic development in the 2026 session.

Why it matters: These tweaks seek to balance affordability and stability, ensuring local governments can adapt while maintaining services.

Medicaid focus: With costs escalating, the focus is on ensuring eligibility accuracy and exploring direct-to-employer health care models for cost efficiency.

Property tax adjustments: Following relief measures, leaders are open to refining laws to balance homeowner relief with local revenue needs.

Data centers: Discussion centers on the benefits and challenges of tech giants‘ data centers, focusing on zoning and transparency issues. (IBJ)

Analysis: Property Tax Changes to Put More Pressure on Businesses, Owners of Low-Value Homes

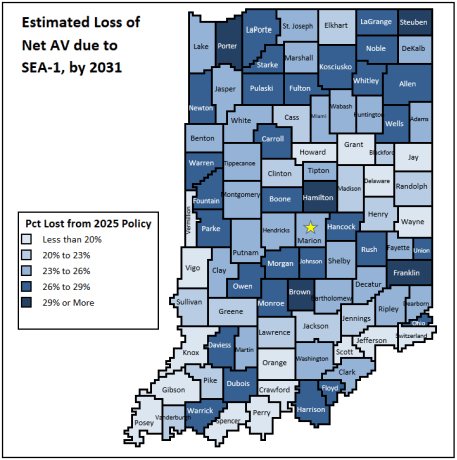

Estimated loss of net assessed value due to changes in Senate Enrolled Act 1, by 2031, according to an Indiana Fiscal Policy report released Nov. 14, 2025. (Screenshot from presentation)

Recent changes to Indiana’s property tax system are set to reduce bills for most Hoosier homeowners, according to an Indiana Fiscal Policy Institute report.

Why it matters: While the changes generally reduce taxes, owners of high-value homes will benefit more than those with lower-value properties.

Key changes:

- The homestead standard deduction will be phased out by 2031, maintaining a fixed $48,000 deduction off taxable value.

- A supplemental deduction will rise from 37.5% to 66.7% by 2031, benefiting pricier homes more due to its percentage nature.

For homeowners:

- Those with homes valued below $102,740 might see tax increases, while pricier homes could see smaller hikes or decreases.

- Counties with high homestead values, like Boone and Hamilton, will see significant tax base impacts.

Looking ahead:

- By 2031, many properties are expected to reach tax caps, with property tax bills for primary residences potentially higher than now but lower than they would have been without the law.

- A new supplemental tax credit starting in 2026 will aid further, reducing taxes by 10% or up to $300 for those hitting the caps. (Indiana Capital Chonicle)

Share the Torchbearer Newsletter with Your Network!

Not signed up for our weekly newsletter? Sign up today!

Important Dates:

Organization Day: Tuesday, November 18th

Anticipated First Day of Legislative Session: Monday, January 5th