1/20/2026 Torchbearer Weekly Policy Update

Thank you for letting us be your trusted source for local, state, and federal policy updates.

Let’s dig in…

- Indiana Set to Opt Out of Some of Trump’s Federal Tax Cuts

- Public Contractor Ban Removed, ‘Good Faith’ Protections Added to Immigrant Work Eligibility Bill

- A $9 Billion Milestone: Indiana529 Reaches New Heights in 2026

- Share the Torchbearer Newsletter with Your Network!

- Important Dates

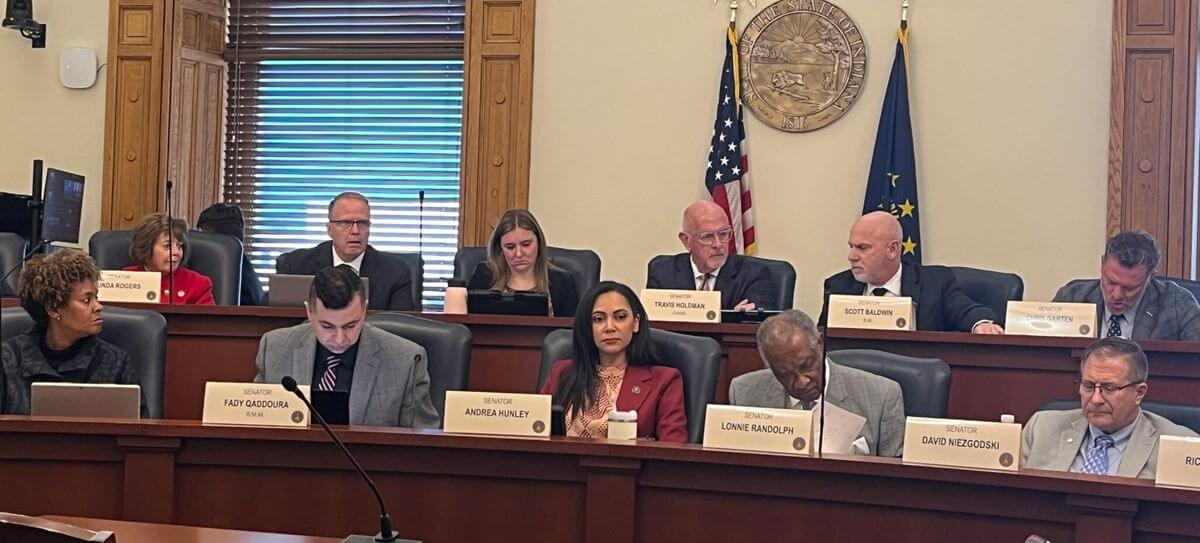

Indiana Set to Opt Out of Some of Trump’s Federal Tax Cuts

Indiana legislators are choosing not to adopt all of the federal tax cuts promoted by President Donald Trump.

Why it matters: The decision impacts how businesses and individuals in Indiana will be taxed, potentially altering financial planning and economic growth for both sectors.

- A significant tax break for businesses from the “One Big Beautiful Bill” is excluded from state taxes.

- Total state tax breaks could exceed $900 million if federal tax changes were fully adopted.

The big picture: The Indiana Senate is moving forward with Senate Bill 212, which adopts some but not all federal tax breaks.

- The bill excludes a costly federal tax cut on production property.

- The Senate Tax and Fiscal Committee is also considering 37 other federal provisions.

What’s next: The bill will proceed to a full Senate vote, with further debates expected on additional tax provisions.

- The Indiana House will review any measures endorsed by the Senate.

- Discussions are ongoing regarding exemptions for overtime and tips income. (Indiana Capital Chronicle)

Public Contractor Ban Removed, ‘Good Faith’ Protections Added to Immigrant Work Eligibility Bill

Legislation in Indiana now requires enhanced use of the E-Verify system for public works projects, following recent amendments to Senate Bill 87.

Why it matters: The changes aim to ensure that taxpayer money is spent only on legal workers, boosting accountability and preventing unauthorized employment.

- The bill expands E-Verify to all public works, closing loopholes previously exploited by some contractors.

What’s new: Employers acting in “good faith” are now protected from civil liability if they mistakenly verify a worker’s eligibility.

- A yearlong ban on violators was replaced with a safe harbor provision, responding to earlier criticisms.

The bottom line: Indiana is further committing to legal employment on public projects, balancing enforcement with practical contractor needs.

- The amended bill has passed committee and is headed to the Senate floor for approval. (Indiana Capital Chronicle)

A $9 Billion Milestone: Indiana529 Reaches New Heights in 2026

Indiana State Treasurer Daniel Elliott announced a historic milestone for the state’s education savings program, revealing that Indiana529 plans have officially surpassed $9 billion in total assets.

Why it matters: More Hoosier families are adopting a “fiscally responsible mindset” by saving for post-high school education, reflecting a shift towards non-traditional education pathways.

- Indiana529 funds can be used at a wide range of institutions, including four-year colleges, trade schools, and apprenticeship programs.

Driving the news: The program now boasts more than 463,000 active accounts, a testament to its growing popularity.

- Indiana residents benefit from state income tax credits worth 20% of contributions, up to $1,500 annually.

The bottom line: Under Executive Director Marissa Rowe, Indiana529 focuses on accessibility, allowing accounts to be opened with as little as $10.

- Tax benefits include tax-deferred growth and tax-free withdrawals when used for qualified expenses.

Go deeper: The Treasurer’s office offers a “Webinar Wednesday” series to help families navigate the program. Visit MyIndiana529.com for more information. (WIBC)

Share the Torchbearer Newsletter with Your Network!

Not signed up for our weekly newsletter? Sign up today!

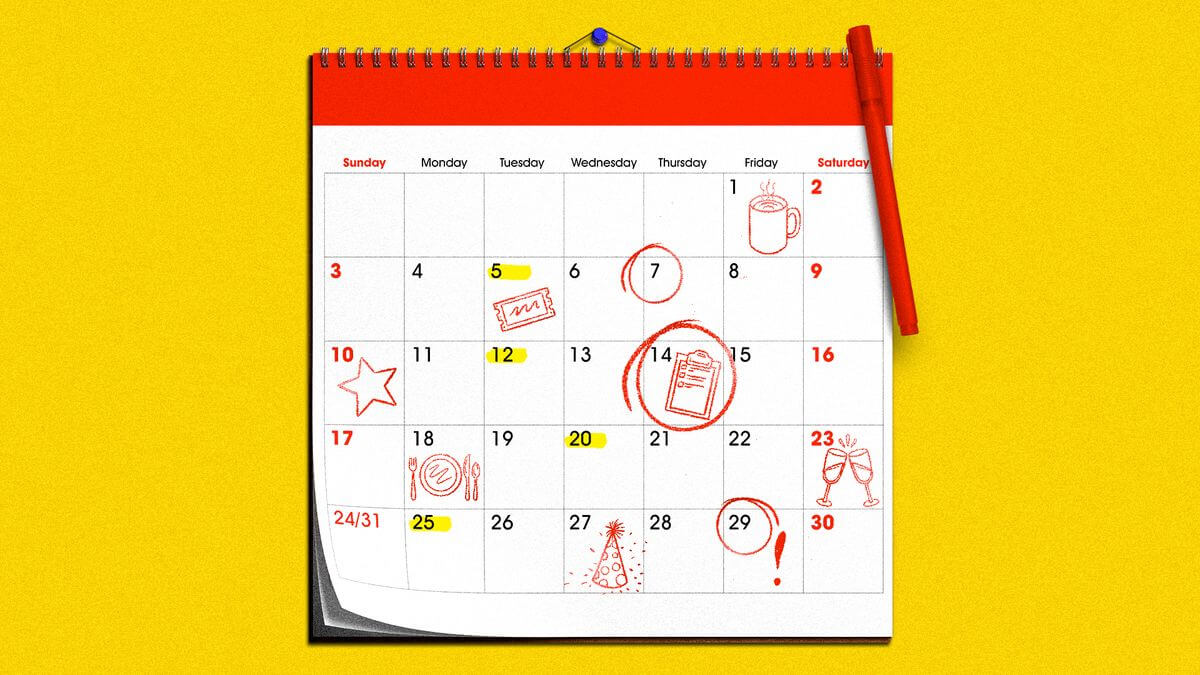

Important Dates:

Important Session Dates:

January 26: Committee Report Deadline (First Half)

January 28: 2nd Reading Deadline (First Half)

January 29: 3rd Reading Deadline (First Half)

February 19: Committee Report Deadline (Second Half)

February 23: 2nd Reading Deadline (Second Half)

February 24: 3rd Reading Deadline (Second Half)

February 25 through 27: Conference Committees

February 27: Anticipated Sine Die